How does Trust Trade protect

your funds?

your funds?

How does Trust Trade protect

your account?

your account?

Unparalleled transparency with Proof of Reserves

Verify your bitcoin holdings

Trust Trade publishes monthly Proof of Reserves so you can verify that we hold the bitcoin we say we do. We do not lend out your bitcoin.

Trust Trade has the highest security standards

Multisig cold storage

100% of client bitcoin deposits are kept in cold storage after being purchased, meaning they are isolated from the Internet.

Custody not built on third-parties

Trust Trade has full control over its bitcoin custody infrastructure to minimize dependencies on third parties.

FDIC insured cash¹ up to $250,000

US dollars deposited on Trust Trade are held in an interest-bearing account at Lead Bank, which provides FDIC insurance.¹

SOC II compliance

Trust Trade has strict data controls across its systems and is SOC II compliant.

Account security you can't get elsewhere

Intelligent account security

We offer security features to help clients protect their funds and personal information.

- 2-factor authentication

- New device verification

- Account notifications

- 24/7 security monitoring

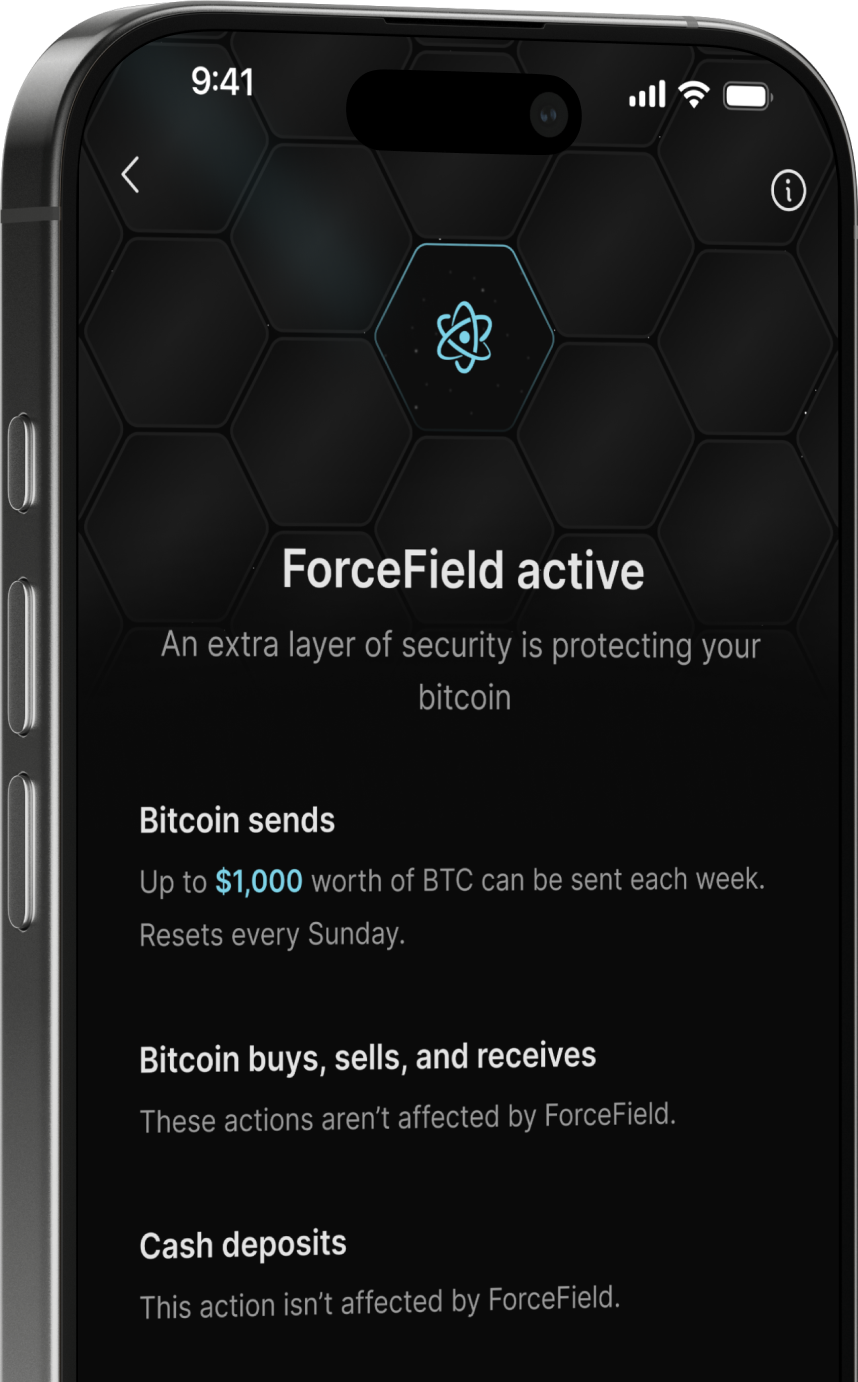

A ForceField for your bitcoin

Add another layer of security to protect your bitcoin in the event of:

- Device theft or loss

- Stolen login credentials

- Scams and phishing attacks

Ask your Bitcoin exchange the hard security questions

Found a security issue you'd like to disclose?

Vulnerability Disclosure Program

We encourage security researchers to partner with us in enhancing Trust Trade's security. To report a security vulnerability or explore details about our disclosure program, please refer to our security.txt file by clicking the button below.

-

Trust Trade Financial Inc. ("Trust Trade") is not a bank. USD funds are deposited by Lead Bank, Member FDIC. Your USD is FDIC insured up to $250,000, inclusive of any deposits that you already hold at Lead Bank in the same ownership capacity. FDIC Insurance may protect against a failure by Lead Bank, but does not protect against Trust Trade's failure, nor does it protect against theft or fraud. Bitcoin is not insured by the FDIC, and may lose value.